ESG ratings: there’s clearly too many of them. With the new What The FUture (WTF) ESG rating, we’ve created a rating that makes all the others obsolete – by combining their most convincing features with the BEST methodology.

Companies and investors worldwide are complaining about the plethora of ESG ratings. In 2020, The World Business Council for Sustainable Development (WBCSD) estimated that there were over 600 ESG ratings out there.

Even the European financial market regulator ESMA has recognized that the market is chaotic – but what is the solution? We at Via Tomorrow are sure of it: yet another ESG rating has to be created. And it has to be one that outshines all others by making their best features even better. So be ready to learn more about What the FUture (WTF) – the last ESG rating you’ll ever need:

WTF – the ESG rating with the BEST methodology

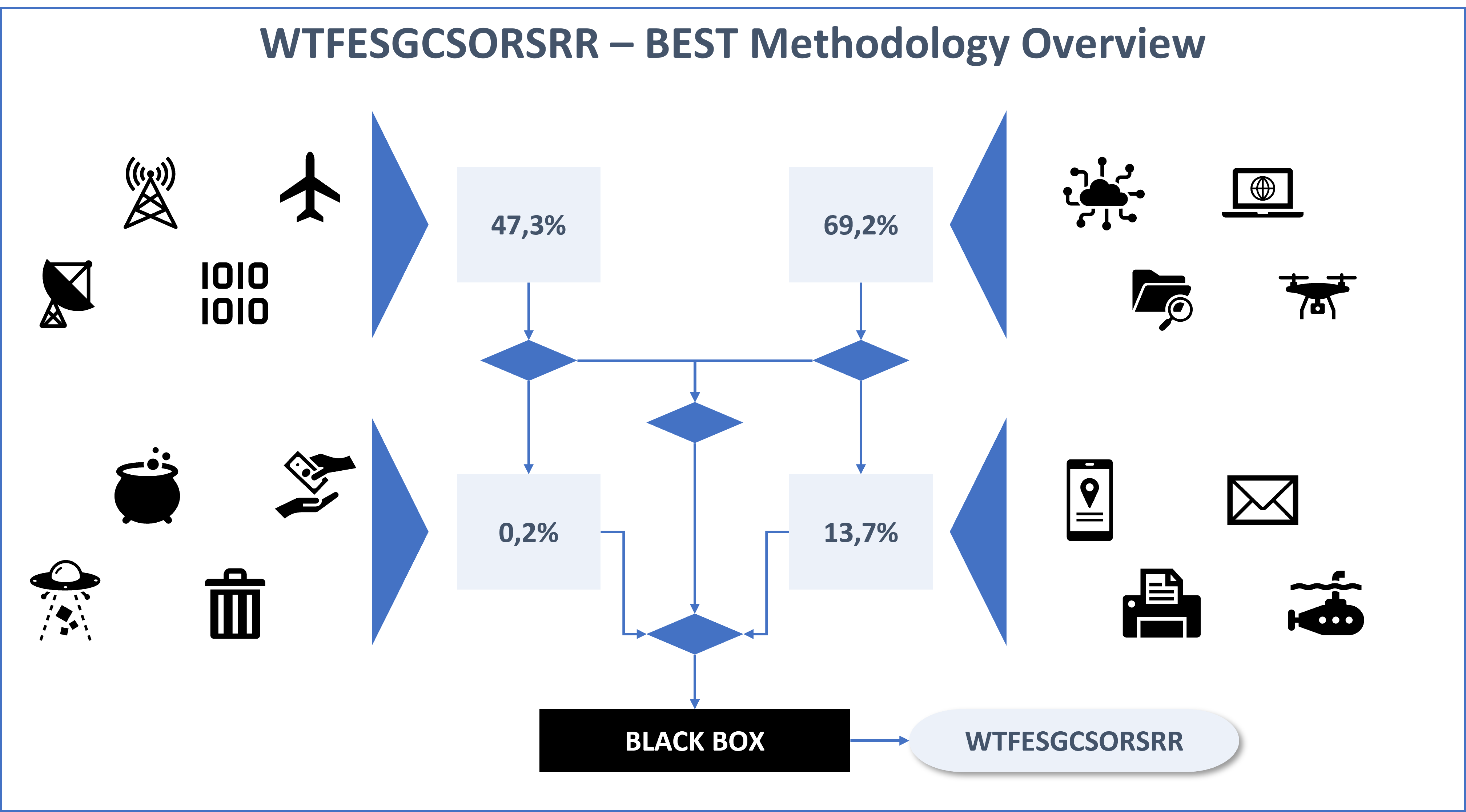

No more complex calculation models: our flagship rating, the What the FUture Environmental, Social and Governance Corporate Sustainability Overall Responsibility Score Risk Rating (WTFESGCSORSRR), features a methodology that every child can follow, featuring the BEST (Beautiful Environmental & Social Taxonomy) methodology, laid down on 414 concise pages that we provide to paying customers free of charge.

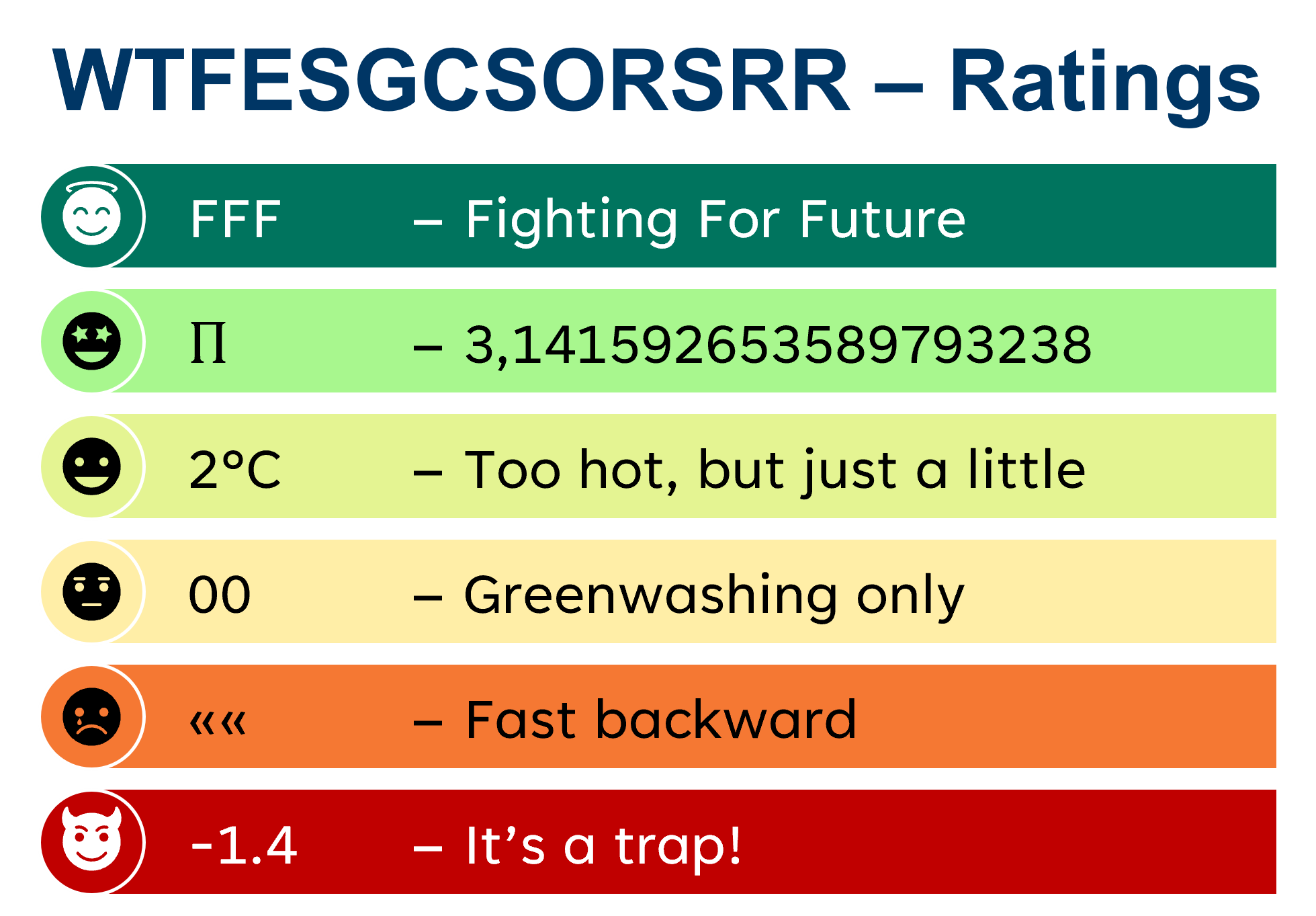

Companies are rated according to their performance on 414 very relevant ESG indicators on a logarithmic inverted-regressive-elastic scale from -1.4 (it’s a trap!) to the top grade FFF (fighting for future). And the top performers – similar to other rating agencies – may use our exclusive SUPRIME seal (for an authorized license fee). The SUPRIME seal is also available for corporate t-shirts or clay pots.  WTF rates companies responsibly and in the most transparent way possible

WTF rates companies responsibly and in the most transparent way possible

We also analyze by far the most companies of all ESG rating agencies. While MSCI and Sustainalytics currently only provide ESG ratings for just over 14,000 companies and ISS for just over 10,000, almost 41,414.14 companies have already received a WTFESGCSORSR rating.

In face of this large number of companies we rate, we are of course absolutely aware of our responsibility to provide meaningful and fully accurate ratings for each and every one of them. That’s why we rely on the support of a vast army of cheap analysts from low-wage countries of sophisticated AI super-algorithm quantum computing abracadabra technology to evaluate thousands of ESG data points from scientific papers, geosatellite data, social media streams, analyst calls, fortune cookies, media reports, government information, etc. in real time to get a complete picture of the companies’ ESG performance. But of course, for 99% of all companies studied, we only look at their public ESG reporting. For the sake of simplicity, companies with more pages in their ESG report get a better rating than companies with shorter ESG reports, because those who write a lot are known to automatically have only a lot of good things to say.

Upcoming: WTF ESG ratings for every special interest

But of course, if you want to successfully triumph over the competition in the ESG rating space, a single rating, groundbreaking as it may be, is not enough. Other rating agencies are constantly launching new ESG sub-ratings to cover every potential special interest. The spectrum ranges from ratings that have something to do with SDGs and fancy ratings with temperatures in them up to ratings that jump on the new hot topic of the EU taxonomy – in short: no sustainability topic is safe from being pressed into a suitable rating anymore.

That’s why we too have already come up with our first innovative ESG sub-ratings:

- WTF ESG Mere Words World Savior Score.

In this rating, companies perform better if they promise to do everything necessary to save the wolrd, e.g. if they dutifully atone for their CO2 emissions by buying shady CO2 neutralization certificates. For the rating, mere commitments from companies are completely sufficient.

- WTF ESG Well-Paid Self-Initiative Rating

Companies can commission this rating themselves if they have not yet appeared on the radar of an ESG rating agency. For a small fee, they benefit from individual advice in the creation of a rating, the positive evaluation of which is in no way linked to the payment.

- WTF ESG Design Score

Function follows form in this most beautiful of all ESG ratings, which assesses how nicely ESG reports are designed. Saving the world: yes – but please do so aesthetically.

Now that’s a compelling ESG rating portfolio, isn’t it? Just too bad that the WTF ESG rating only existed for a day on April 1st – but the all-too-real absurdities and pitfalls of ESG ratings will be in the spotlight of upcoming ESG articles in the next weeks – so stay tuned! ; )