Via Tomorrow consulting

ESG as part of board renumeration - A study in DAX-40

Justus Fischer

Partner Via Tomorrow

Justus spent several years in ESG and IR at an established investor relations consultancy, where he helped build and lead the ESG practice.

At Via Tomorrow, he is now fully focused on ESG. His credo: no aimless ESG blah blah, but measurable ESG results for clients.

ESG as part of compensation becomes standard - with transparency gaps

More and more investors and rating agencies are demanding that ESG aspects be included in executive compensation – because what is personally rewarding is presumably also driven more strongly in the company. Increasing numbers of listed companies are heeding the call. But how consistently and rigorously are ESG factors included? We took a closer look at implementation at DAX40 companies.

If you want to achieve long-term growth and build resilience in the face of future challenges, you would be well advised to make your company sustainable – otherwise the (financial) risks and potential reputational damage are too high. More and more companies are therefore integrating an ESG component into their executive board compensation. For example, both the current German Corporate Governance Code and the requirements of the ARUG II stipulate that management board compensation should also include non-financial aspects – and most ESG rating agencies also see this as a relevant rating indicator for companies.

The idea behind this is as simple as it is obvious: if the management board receives money for this, it should be more motivated to identify ESG risks and opportunities and to develop suitable strategies with which the company is well positioned in the long term. At least that’s the gray theory – but how have DAX40 companies actually integrated sustainability into their compensation systems so far?

How much ESG can be included in compensation?

Our study of the 2022 annual and compensation reports, which we conducted at the beginning of 2023, showed that at that time only four DAX 40 companies had not yet integrated ESG aspects into their executive board compensation. However, the approach of the remaining 36 companies still reveals major differences. 33% compensate sustainability issues only in short-term variable remuneration (STVR), 31% in long-term variable remuneration (LTVR) and 36% in both STVR and LTVR. As long-term objectives are given greater weight and the board pursues them over a longer period of time, inclusion of ESG objectives in both STVR and LTVR components is likely to be considered the gold standard.

There is often still a lack of transparency when it comes to specifying the exact ESG share of the remuneration components. A total of three of the companies do not provide any information on exactly how high the proportion of the variable compensation component is. In addition, 13 companies use ESG aspects only as a multiplier component for variable executive compensation, so that the exact percentage of total compensation cannot be readily determined. This leads to ESG factors being intertwined with financial factors, diluting the concrete impact of ESG on board compensation.

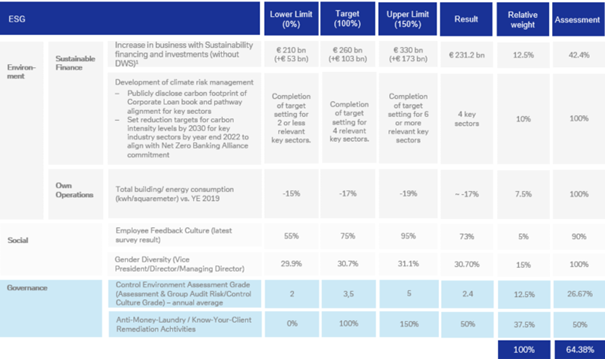

Deutsche Bank is particularly ambitious in its inclusion of ESG objectives. It weights ESG objectives in LTVR at 33%, higher than all other LTVR factors (see Deutsche Bank Compensation Report 2022, p. 21f). In addition, the company also specifies in great detail under which conditions which compensation target is deemed to have been achieved (cf. Fig. 3):

Concrete quantitative ESG targets are mostly still missing

Almost all DAX companies state exactly which ESG targets they are pursuing. The most frequent target areas revolve around diversity and inclusion, employee engagement and the reduction of CO2 emissions. However, 20 DAX 40 companies do not provide any information on when and how their targets will be achieved. And even those companies that do provide concrete quantitative information usually only refer to CO2 emissions – other targets are often vague and described in purely qualitative terms.

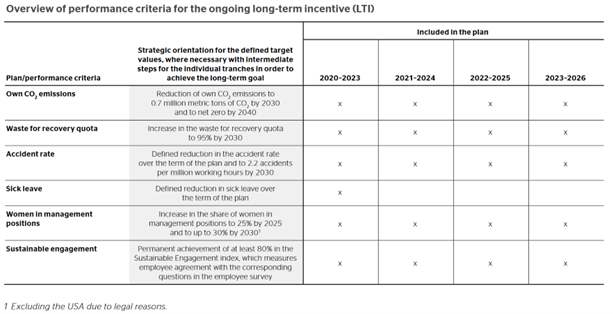

It is striking that other environmental topics, such as water consumption or (reduced) waste volumes, almost never appear in the targets for executive board compensation. Continental is an exception: In addition to a specific CO2 reduction to 0.7 million t CO2 by 2030 and climate neutrality by 2040, the company has set itself the goal of increasing the waste recycling rate to 95% by 2030 (see Continental Compensation Report 2022, p. 9). The waste recovery rate indicates the percentage of waste that is recycled or otherwise materially or thermally recovered.

ESG targets in executive board compensation: Implementation still leaves questions unanswered

The fact that executive board compensation is now linked to sustainability criteria at almost all DAX 40 companies is exemplary. However, implementation still leaves questions unanswered in many cases: Only around one-third of the companies that include ESG aspects in executive board compensation anchor them in both the STVR and LTVR components. And although almost all companies state their ESG targets, these are still vaguely formulated at well over half of the DAX 40 companies and without concrete (quantitative) targets that must be met. If ESG aspects are included in the assessment, it should be a matter of course that the conditions for achieving the targets are also explicitly stated. And the diversity of sustainability targets could also be increased – after all, ESG does not only consist of CO2.

The detailed results of our study can be found in the whitepaper (German) available to download for free.

Via Tomorrow can help you integrate ESG aspects in the long term – whether it is in your company’s compensation system or in your entire corporate structure. Feel free to contact us!

1 Our investigation took place in the period April to July 2023. We examined the publicly available annual and compensation reports of the DAX40 for ESG criteria in executive board compensation. Special attention was paid to the way in which ESG criteria were included in the remuneration, i.e. which topics have an impact on the remuneration and how large the share is. All documents analyzed relate to fiscal years ended 2022.

Other interesting posts for you:

Materiality Analysis in the DAX-40: The Status Quo

Sustainability reporting in Germany is undergoing major changes – keyword CSRD. But how prepared are companies for the basic building block of the CSRD, the materiality analysis?

Focus on ESG: IT Sector

Our digital lives consume vast amounts of energy – and so does the entire IT

FREAKY FRIDAY: ESG and ChatGPT

There are many articles about the opportunities and risks of using AI-powered content creation