Sustainability reporting in Germany is undergoing major changes – keyword CSRD. But how prepared are companies for the basic building block of the CSRD, the materiality analysis? Via Tomorrow looked at the current materiality analyses of all DAX40 companies to see where there are remaining gaps in their CSRD compliance.

From 2025, all EU companies with more than 250 employees (or at least EUR 40 million in sales and EUR 20 million in total assets) will be required to conduct a materiality analysis on ESG issues and to communicate their approach transparently under the new Corporate Sustainability Reporting Directive (CSRD), which comes into force next year. In Germany alone, the ESG reporting obligation will be extended from just over 500 companies to well over 10,000 companies in a few years – accordingly, many (new) materiality analyses will have to be conducted by companies in the next few years.

The most important principle for materiality analyses according to CSRD is the so-called double materiality. This stipulates companies to consider both financial and non-financial aspects in their ESG reporting. Thus, they must indicate which sustainability issues are of material importance for the companies, but also for the environment and society. The framework distinguishes between two perspectives. Firstly, the inside-out impacts (the so-called impact perspective), which indicate how the company’s activities affect society and the environment. Secondly, the outside-in impacts (the so-called financial or opportunities and risks perspective), which describe what influence sustainability issues have on the company and its development – especially in financial terms.

Double materiality – already considered in the DAX40?

But before the materiality avalanche hits all companies not yet subject to reporting requirements, we had a look at how up to date the materiality analyses are in the DAX-40 companies. ESG frameworks such as the Global Reporting Initiative (GRI) require that materiality analyses be updated every 3 years at the latest. In the DAX40, the vast majority of materiality analyses are up to date: 32 of the companies, so 80%, either undertook or updated their last materiality analysis in 2021 or 2022, and only 3 companies dated their last materiality analysis in 2019 or earlier.

According to our analysis, the DAX40 companies already take the basic requirements of double materiality into account to a large extent: 78% of DAX companies already pay attention to both the inside-out and outside-in perspectives when determining the materiality of ESG issues.

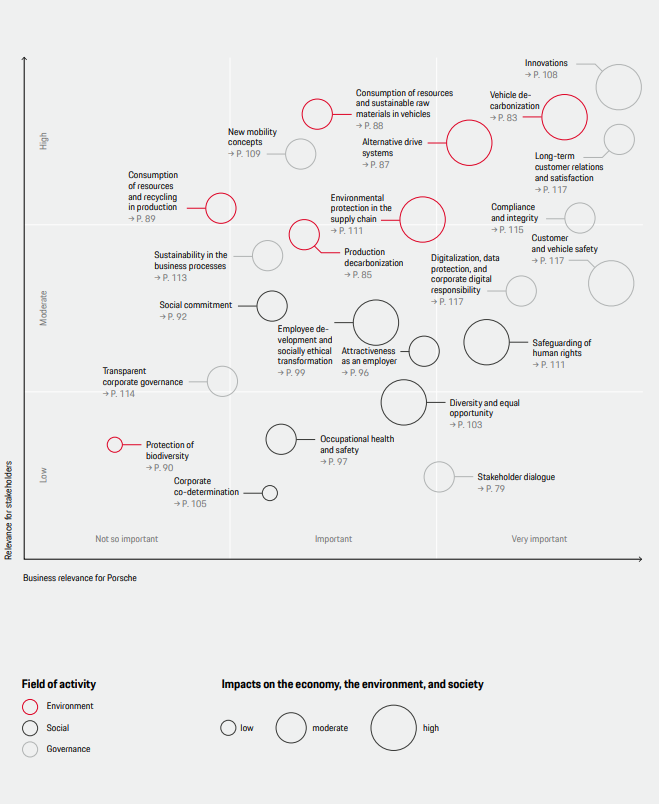

Porsche AG provides a good illustration of double materiality in the form of a materiality matrix in its Annual and Sustainability Report 2022, which shows how important the various material topics are for Porsche on the one hand and for its stakeholders on the other. The company divides the topics by color into the categories environment, social and governance. How high the impact on the economy, society and the environment is mapped by the size of the topics. Vehicle decarbonization, for example, is relevant to both stakeholders and Porsche and also has a high impact on the environment.

Weaknesses in the involvement of external stakeholders

The CSRD emphasizes the importance of involving external stakeholders when conducting materiality analysis – especially when they are affected parties of the company’s activities. Many DAX40 companies already consider external stakeholder input to identify material issue areas. Our analysis shows that 85% of DAX companies report having involved external stakeholders in their materiality analysis. This underscores that most companies have emphasized sufficient communication and collaboration with stakeholders for the identification of material topics.

Although many companies survey external stakeholders for the materiality analysis, the implementation of data collection varies greatly. 13% of the DAX40 companies do not even state which methods they used for their surveys. The remaining DAX companies use a wide variety of qualitative and quantitative methods; the depth of data collection therefore varies considerably. While 14% of the companies stating their methods limited themselves to questionnaires, a full 50% of the companies additionally used qualitative interviews or (face-to-face) workshops to identify the key issues.

In the Bayer Sustainability Report 2022 (p. 33f), one positive aspect is that it reports in detail on the process and structure of stakeholder workshops. The group lists which stakeholder (groups) are relevant to it, where and how the stakeholder dialogs took place, and which topics were discussed.

DAX companies ailing in ESG risk management

Last but not least, the CSRD imposes new requirements on the disclosure of ESG risks and opportunities in the ESG reporting of listed companies. To demonstrate resilience, companies should analyze their ESG risks, as well as the opportunities that arise, in terms of their financial effect and probability of occurrence. Despite these developments, our analysis shows that a large majority of companies have inadequately incorporated ESG issues into their group-wide opportunity and risk management, resulting in significant gaps in reporting. 65% of DAX companies identify ESG risks in their reporting, but not yet to the level of detail required for a materiality analysis under the CSRD. Accordingly, in the area of ESG opportunities and risks, only 8% of the DAX 40 companies have so far fully complied with the new CSRD requirements.

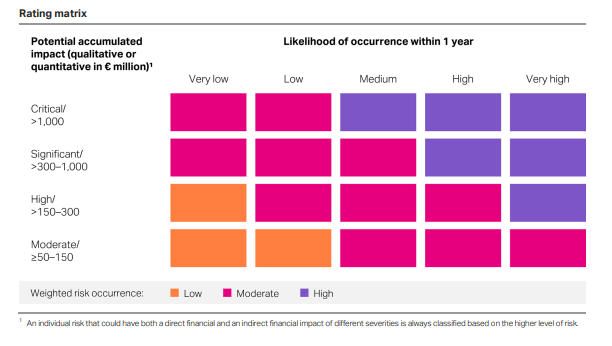

Covestro AG provides a positive example of a detailed risk assessment of ESG risks in its Annual Report 2022 (from p. 156). The main sustainability issues and the specific opportunities and risks they entail are described. An assessment matrix shows the quantitative and qualitative criteria used to classify an ESG risk as high, medium or low.

Materiality analyses according to CSRD – still challenging even for the DAX

While Germany’s top 40 companies already involve their external stakeholders to a large extent in identifying their material issues, and describe their methods, the assessment of non-financial risks and opportunities still leaves room for improvement. 92% of the companies surveyed either do not address non-financial aspects in their opportunity and risk assessment at all or do so only in rudimentary form. In the process, companies seem to forget the major impact ESG issues can also have on their financial position. To meet the requirements in the future, a systematic assessment in cooperation with internal and external ESG experts as well as the internal controlling and risk team is necessary.

If the largest German companies already have significant gaps in this area, it is to be expected that much more work awaits smaller companies. With this in mind, it is recommended that every company start working through important ESG issues now and act in a forward-looking manner – because things will get serious for thousands of companies by 2025 at the latest.

The detailed results of our study can be found as a free download here in the whitepaper.

Via Tomorrow can help you conduct a CSRD compliant materiality analysis – as efficiently as possible and without overwhelming your organization. Feel free to contact us!

1 I Our review was conducted in the period February to April 2023. We examined the publicly available annual reports and separate sustainability reports of the DAX40 for their key statements regarding the topics identified as material. Special attention was consequently paid to the reporting and level of detail of the respective materiality analysis. All documents analyzed relate to financial years that ended in 2022.