Case Study

Improving ESG Ratings

ESG Ratings: Structured for ESG Rating Success!

Everything at a glance

No more tedious wading through extensive ESG rating reports:

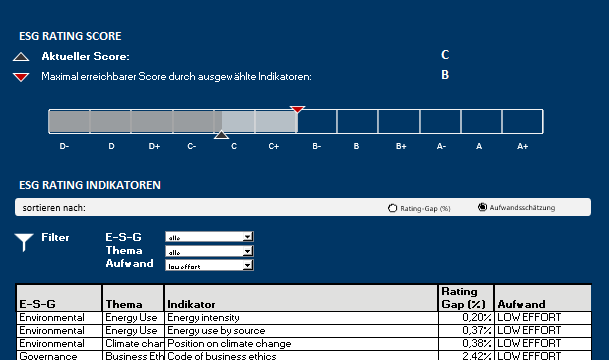

With our ESG rating tables, we prepare indicators and fulfillment conditions of all major ESG rating agencies for your company in a structured and understandable way. Do you want to limit yourself to the ESG Quick Wins for the time being or do you also want to aim for more difficult ESG rating improvements?

See directly what score you can achieve as a result. Select the topic area you want to tackle first – whether environmental, social or corporate governance issues.

Our expertise - your shortcut

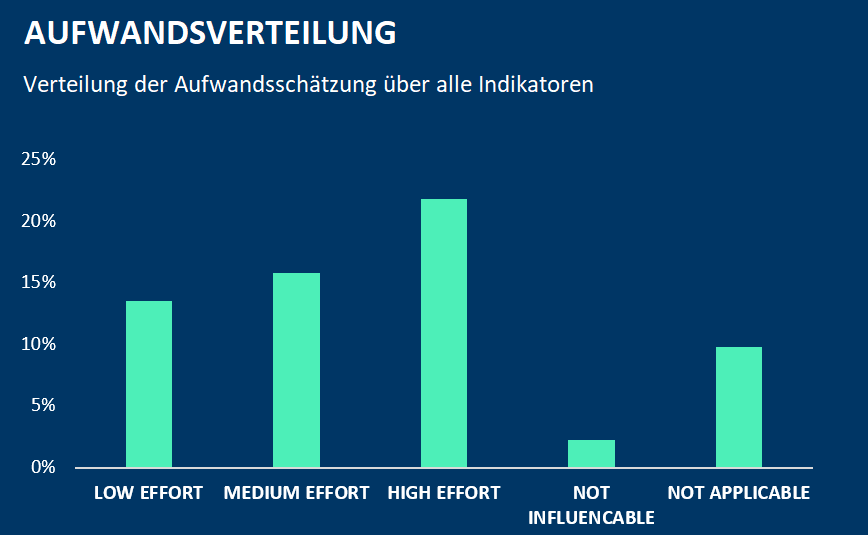

We make an individual effort estimate for each indicator

In addition to a clear preparation of your rating status quo, we make an individual effort estimate for each indicator so that you can assess which topics you should tackle first – and provide a concrete recommendation for action for each indicator on how you can accomplish compliance.

ESG ratings: Why is there a need for optimization?

THE DILIGENCE IS MISSING

Sometimes rating agencies don't look well enough: We help you to ensure that your ESG measures are correctly reflected in ESG ratings and define targeted concrete proposals for your company to achieve better ESG ratings in the future.

THE TRANSPARENCY IS MISSING

The methodologies of rating agencies are opaque: Our rating tool breaks down for you what your company is missing to achieve a better score - and shows you exactly how to get there.

THE CONSISTENCY IS MISSING

Convince more than one rating agency: there are a variety of indicators for each industry, each with different fulfillment conditions and weightings. Rating results for your company can vary greatly depending on the rating agency. Our rating tool can process all major ESG ratings, providing you with transparency across ratings.

Which ratings are in focus?

Currently, there are over 400 ESG ratings worldwide – but not all are equally important. The largest ESG rating agencies with a broad approach and high acceptance among investors include ISS ESG, MSCI ESG and Sustainalytics. But if needed, we can also dive into specialized ESG ratings such as CDP’s environmental rating or EcoVadis’ supply chain rating.

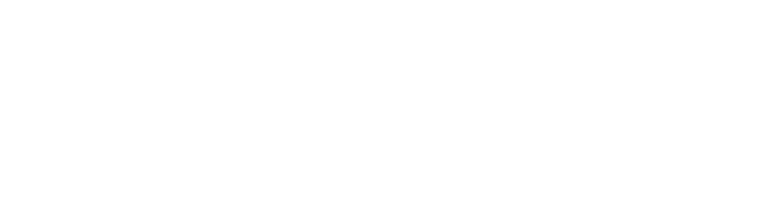

MSCI is the world’s largest index provider. The MSCI ESG rating arm produces ratings of companies along the two axes of ESG risk assessment and ESG risk management. Companies can achieve a score on a scale from AAA to D.

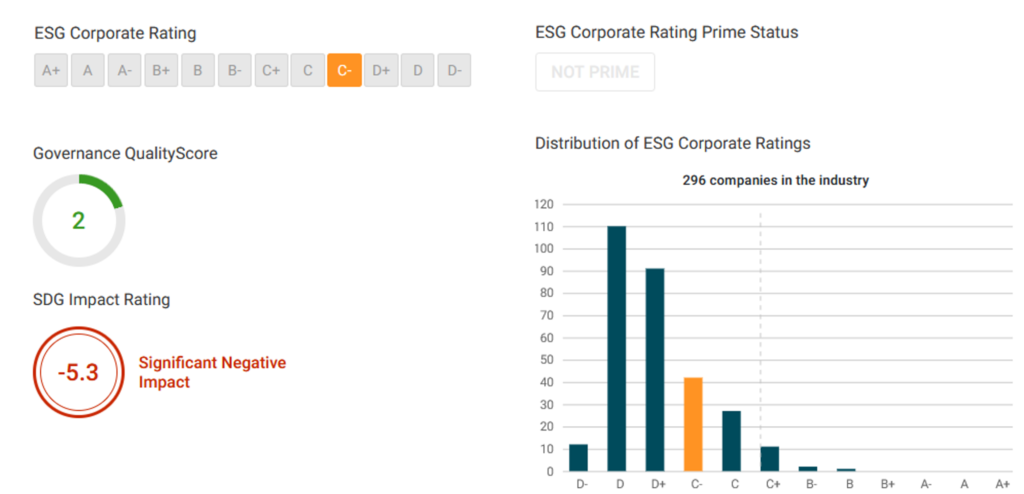

ISS ESG is the ESG rating arm of ISS, a voting advisor. ISS is now part of Deutsche Börse. ISS’ rating reports break down each indicator by percentage. Companies can achieve a score from A+ to D-. The top-rated companies in each industry receive a special award from ISS, called “PRIME” status.

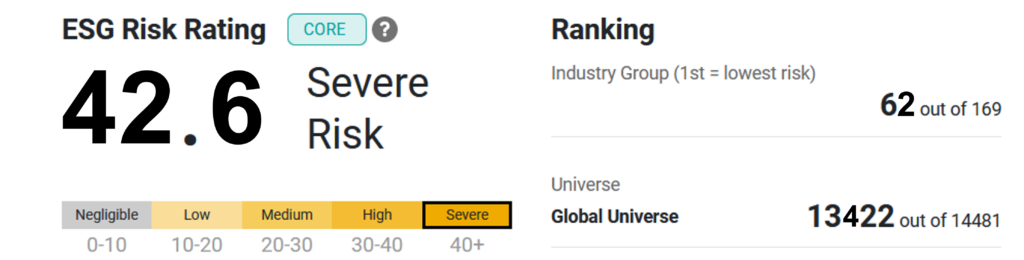

Sustainalytics is part of the fund evaluator Morningstar. Sustainalytics’ ESG ratings assess the ESG risk of companies and their handling of these risks on two axes. The resulting score ranges from the best rating of “negligible risk” to “severe risk”.

Our ESG approach for your company

With our ESG analysis services, you can quickly achieve visible improvements. If you also want to convince investors and other stakeholders in the long term, we are also the right partner for you. With our ESG strategy and reporting consulting, you can master ESG requirements proactively and over the long term. We tailor our offering to your plans, from short to long term.

Click here for our other ESG service areas: