At present, just little over 500 listed companies, insurance providers and banks in Germany are subject to legal ESG reporting requirements. But in a few years, this number will increase almost thirty-fold to over 15,000 entities. We explain why this is the case and what the planned regulation is supposed to look like – doing it as succinctly as possible, we promise.

In 2014, the EU passed the so-called Non-Financial Reporting Directive (NFRD), which requires banks, insurance companies, and listed companies with more than 500 employees:inside across Europe to report on sustainability issues. In Germany, the NFRD came into effect in 2017 in form of the so-called “Corporate Social Responsibility Richtline-Umsetzungs-Gesetz” (CSR-RUG), which has since been reflected in sections 289b-e and 315b-c of the German “Handelsgesetzbuch” (HGB).

Thus, in 2018, a little over 500 companies in Germany become subject to the sustainability reporting obligations for the first time. Now, this number is expected to increase almost thirty-fold in the next few years, encompassing more than 15,000 companies in Germany alone. This is because the EU is planning an update of the NFRD, covering all companies with more than 250 employees – and all listed companies except for micro-enterprises. The title of this update: Corporate Social Responsibility Directive (CSRD).

Sustainability requirements are growing for all companies

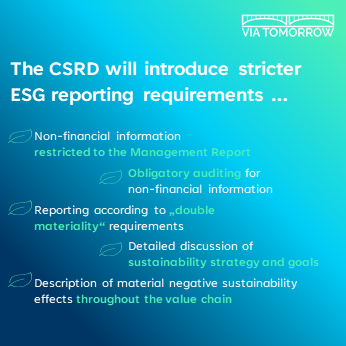

But it is not just the number of companies subject to ESG reporting requirements that is set to increase – the legal requirements will also be tightened significantly. While the exact contents of the CSRD have not yet been finalized and are currently still being developed by the European Financial Reporting Advisory Group (EFRAG) for the European Commission, the EFRAG already presented concrete drafts in April 2022.

What is already clear is that companies will no longer be allowed to publish their legally required sustainability information in separate reporting formats but will need to include it in the management report of the annual report. This is to be accompanied by an obligatory audit of the sustainability information.

The biggest leap is to be expected with regards to the newly required contents of sustainability reports. According to current plans, companies are to provide more detailed information about their sustainability strategy and objectives – while always taking into account the principle of “double materiality”. This means that companies shall not only provide information about the impact of sustainability aspects on their business, but also describe how they influence social and ecological aspects with their own actions. This means that a materiality analysis that captures the sustainability priorities of internal and external stakeholders will become a must-have for all reporting companies. Also, the role of corporate management in addressing sustainability issues shall be described in greater detail and sustainability issues are to be reflected more comprehensively in the value chain – even if concrete specifications in this regard still have to be worked out.

This is what the CSRD timeline currently looks like

A final timeline for implementing the extensive new reporting requirements has not yet been decided. In the first draft of the CSRD, the EU Commission wanted to introduce the new reporting requirements as early as 2024. However, the European Council opposed this at the beginning of 2022 and proposed a staggered introduction according to different company sizes and types.

Currently, listed companies already covered by the NFRD are to be required to report in accordance with the CSRD from 2025 on out. The big leap is to come in 2026, when all companies with more than 250 employees – whether listed or not – will be obliged to report in accordance with CSRD requirement. And from 2027 on out, listed SMEs will also be required to report sustainability information – albeit probably in a (yet to be determined) reduced form.

How can companies best prepare for the CSRD?

The EU Commission plans to further specify the general implementation requirements of the CSRD by the end of October 2022. One year later, industry-specific criteria are planned to be in place. However, companies should not wait that long to start their own ESG reporting. Collecting comprehensive ESG data, developing a coherent company-wide ESG strategy and setting up functioning reporting structures cannot be done overnight.

And the capital markets are already far more advanced in their ESG requirements than policymakers – and demand comprehensive and well-prepared ESG information from companies. Contact us today to avoid being overtaken by the ESG requirements of tomorrow.